The Role of Consultants in Modernizing Financial Institutions

The banking and financial services industry is evolving rapidly, driven by digital transformation. Traditional banking methods are being replaced by AI-driven automation, blockchain technology, cloud computing, and advanced analytics. Financial institutions must adapt to these changes to stay competitive, improve customer experience, and meet regulatory requirements.

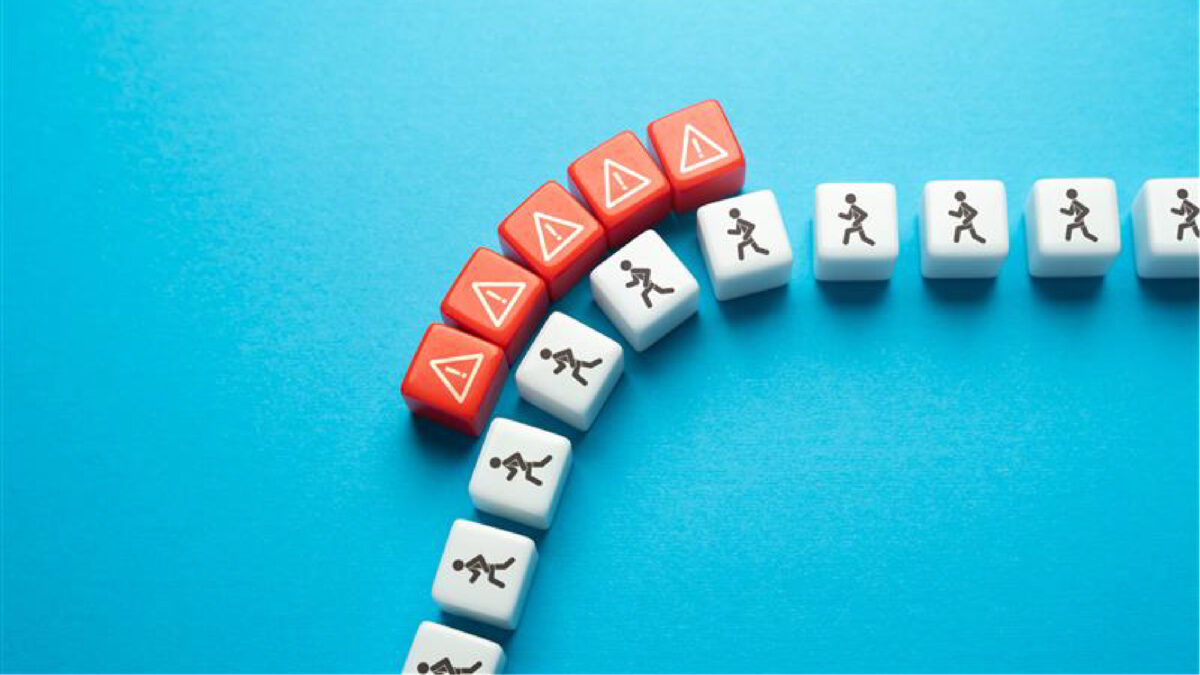

However, digital transformation is complex, and many banks struggle with legacy systems, cybersecurity risks, and compliance challenges. This is where financial consultants play a crucial role—helping institutions develop and implement digital strategies that drive efficiency, security, and innovation.

How Digital Transformation is Changing Banking

The shift toward digital banking offers several benefits:

✅ Faster and More Secure Transactions – Online banking, mobile apps, and blockchain technology ensure secure and instant transactions.

✅ Improved Customer Experience – AI-powered chatbots, mobile banking, and personalized financial services make banking more accessible and convenient.

✅ Data-Driven Decision-Making – Banks use big data and AI to analyze customer behavior, detect fraud, and improve financial planning.

✅ Automated Compliance & Risk Management – Digital tools help banks comply with regulations efficiently and accurately, reducing human errors.

The Role of Consultants in Digital Transformation

Financial consultants help banks and financial institutions navigate digital transformation by providing expert insights, technical solutions, and risk management strategies. Their key contributions include:

🔹 Assessing Digital Readiness – Evaluating current technology, security risks, and compliance gaps to create a customized digital strategy.

🔹 Implementing Fintech Solutions – Integrating AI, blockchain, cloud computing, and automation tools to streamline banking operations.

🔹 Cybersecurity & Risk Management – Ensuring secure transactions and data protection through advanced cybersecurity measures.

🔹 Regulatory Compliance Support – Helping institutions adapt to changing financial regulations using digital tools for accurate reporting.

🔹 Training & Change Management – Guiding employees and stakeholders through the transition to new digital systems.

The Future of Digital Banking

As financial technology continues to evolve, banks that embrace digital transformation will gain a competitive edge. From AI-driven financial advisory services to decentralized finance (DeFi), the future of banking will be more automated, data-driven, and customer-focused.

By partnering with expert financial consultants, banks and financial institutions can accelerate their digital journey, improve efficiency, and stay ahead of industry disruptions.

The future of banking is digital—and now is the time to adapt.